Loan

Providing the best Loan to customers.

what we’re offering

We’re giving all the loan services to you

Personal Loans

ersonal loans are a flexible financing option that can help cover unexpected expenses, consolidate debt, or fund major purchases. They are typically unsecured, meaning no collateral is required, and come with fixed interest rates and repayment terms. Borrowers can choose loan amounts based on their financial needs and creditworthiness. With quick approval processes and competitive rates, personal loans offer a convenient way to manage finances and achieve financial goals.

Home Loans

Home loans provide financial assistance for purchasing, building, or renovating a home. These loans typically come with fixed or variable interest rates and repayment terms that can range from 10 to 30 years. Borrowers can choose from various options, including conventional, FHA, and VA loans, depending on their financial situation and eligibility. With competitive rates and flexible terms, home loans make homeownership more accessible by spreading the cost over manageable monthly payments.

Car Loans

Car loans help individuals finance the purchase of a new or used vehicle by spreading the cost over fixed monthly payments. These loans typically come with competitive interest rates and repayment terms ranging from a few years to several years. Borrowers can choose between secured loans, which require the car as collateral, or unsecured options with higher interest rates. With flexible terms , car loans make vehicle ownership more affordable and accessible.

Education Loans

Education loans provide financial support to students and parents to cover tuition fees, books, and other educational expenses. These loans often come with flexible repayment options and competitive interest rates, with some offering deferred payments until after graduation. Government-backed and private loan options are available and needs. Education loans make higher education more accessible by easing the financial burden and allowing students to focus on their studies.

Business Loans

Business loans provide financial support to entrepreneurs and companies for starting, expanding, or managing business operations. These loans come in various forms, including term loans, lines of credit, and SBA loans, with repayment terms tailored to business needs. They can be used for purchasing equipment, hiring staff, or boosting cash flow. With competitive interest rates and flexible financing options, business loans help businesses grow and achieve their financial goals.

Gold Loans

Gold loans allow individuals to borrow money by pledging their gold ornaments or assets as collateral. These loans offer quick approval, minimal documentation, and lower interest rates compared to unsecured loans. The loan amount is determined based on the gold’s value, and repayment options are flexible, including interest-only or EMI-based plans. Gold loans are a convenient and reliable way to access instant funds for personal or business needs without selling precious assets.

Mortgage Loans

Mortgage loans help individuals and businesses finance the purchase of real estate by offering long-term funding with structured repayment plans. These loans are secured by the property itself, making them a lower-risk option for lenders, often resulting in competitive interest rates. Borrowers can choose from fixed or variable interest rate options, with repayment terms typically ranging from 10 to 30 years. Mortgage loans make homeownership and property investment more accessible by spreading the cost over manageable monthly payments.

Payday Loans

Payday loans are short-term, high-interest loans designed to provide quick cash for urgent financial needs. They are typically repaid on the borrower’s next payday and require minimal documentation for approval. While payday loans offer fast access to funds, they often come with high fees and interest rates, making them an expensive borrowing option. Borrowers should use them cautiously and consider alternative financing options if available.

Credit-Builder Loans

Credit-builder loans are designed to help individuals establish or improve their credit scores. Unlike traditional loans, the borrowed amount is held in a secured account and only released after the loan is fully repaid. Monthly payments are reported to credit bureaus, helping borrowers build a positive credit history. With low borrowing limits and manageable terms, credit-builder loans are a great option for those looking to strengthen their financial profile and gain access to better credit opportunities in the future.

Consolidation Loans

Consolidation loans help borrowers combine multiple debts into a single loan with a fixed interest rate and structured repayment plan. This simplifies debt management by reducing multiple payments into one, often with a lower monthly payment or interest rate. These loans are commonly used to consolidate credit card debt, medical bills, or personal loans. By streamlining repayments and potentially lowering costs, consolidation loans can make it easier for borrowers to regain financial stability and pay off debt faster.

Secured Loans

Secured loans require borrowers to provide collateral, such as a home, car, or savings, to obtain financing. Because they are backed by assets, these loans typically offer lower interest rates and higher borrowing limits compared to unsecured loans. Common types include mortgage loans, auto loans, and home equity loans. Secured loans are ideal for individuals seeking larger loan amounts with manageable repayment terms, but failure to repay may result in the loss of the pledged asset.

Unsecured Loans

Unsecured loans do not require collateral, making them a flexible borrowing option for individuals who may not have assets to pledge. These loans are granted based on the borrower’s creditworthiness, income, and repayment history. Common types include personal loans, credit cards, and student loans. While unsecured loans offer quick access to funds, they typically come with higher interest rates compared to secured loans. They are ideal for covering various expenses, from medical bills to debt consolidation, without the risk of losing property.

Installment Loans

Installment loans allow borrowers to receive a lump sum of money and repay it in fixed monthly payments over a set period. These loans can be secured or unsecured and are commonly used for personal, auto, mortgage, and student loans. With predictable payments and structured terms, installment loans help borrowers manage their finances effectively. They often come with competitive interest rates and flexible repayment options, making them a convenient choice for large expenses.

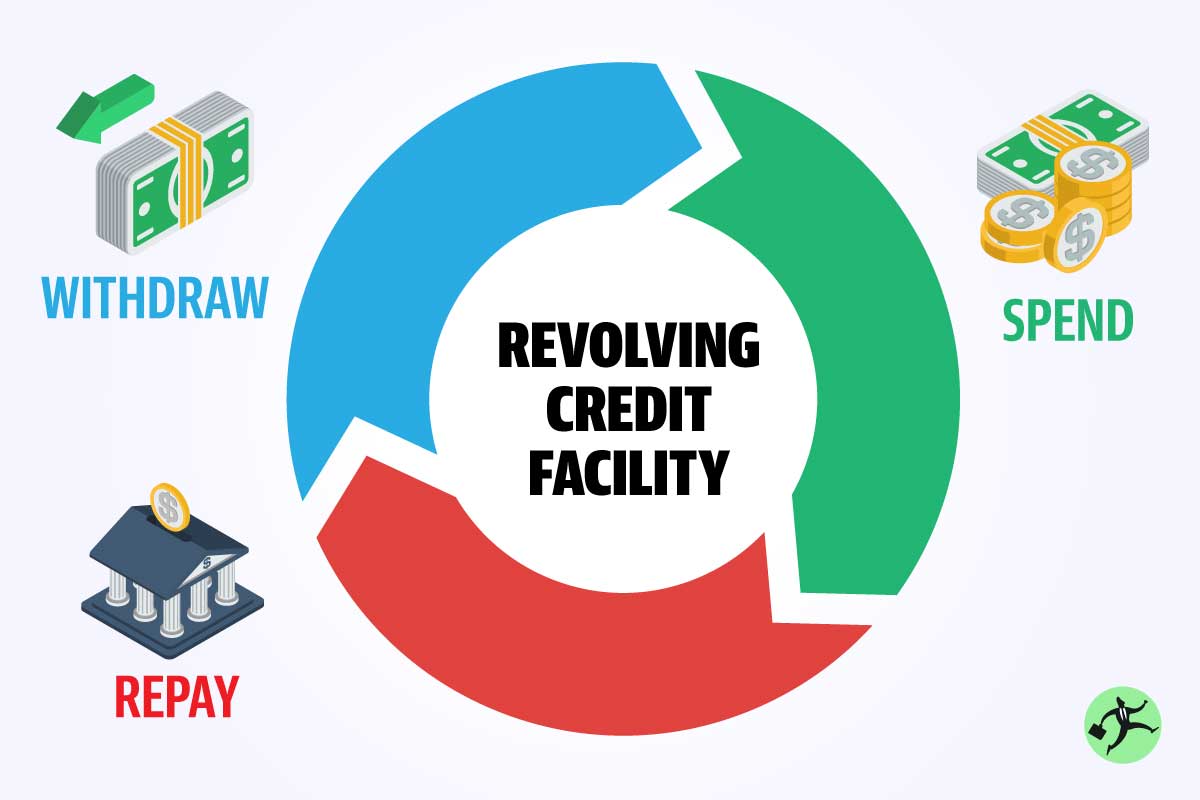

Revolving Loans

Revolving loans provide borrowers with a flexible credit line that can be used, repaid, and reused as needed. Unlike installment loans, there is no fixed repayment schedule, though minimum monthly payments are required. Common examples include credit cards and lines of credit. Interest is only charged on the amount borrowed, making revolving loans a convenient option for managing cash flow and unexpected expenses. They offer financial flexibility but require responsible borrowing to avoid high-interest debt.

Balance Transfer Loan

A balance transfer loan allows borrowers to move existing high-interest debt, such as credit card balances, to a new loan with a lower interest rate. This helps reduce interest costs and simplifies debt repayment by consolidating multiple payments into one. Balance transfer loans are ideal for individuals looking to save on interest and pay off debt faster. However, borrowers should be mindful of transfer fees and promotional rate expiration dates to maximize savings.